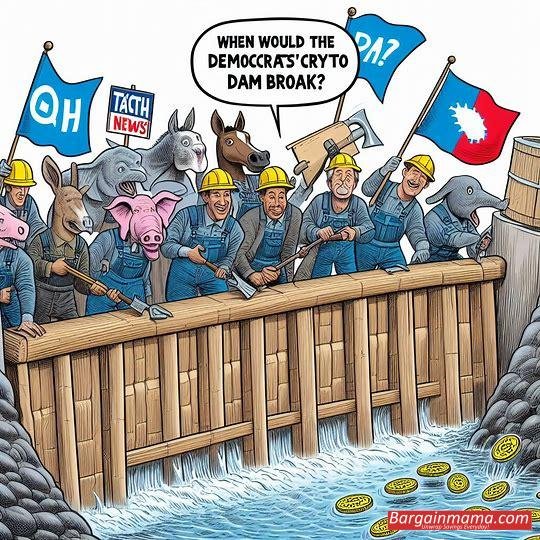

It started out small, with a few obstinate Democrats in Congress who would not go exactly by the party line that their leaders had established. Over the course of the last month, more of their colleagues—including the influential Senate Majority Leader Chuck Schumer (D-N.Y.)—joined them in supporting a piece of bitcoin legislation, which intensified the initial hostility. The ideological hardline imposed by the progressive wing of the party was essentially washed away on Wednesday when 71 Democrats joined 208 Republicans in the House of Representatives to pass another pro-crypto law, this one clarifying the regulatory authority of the SEC and CFTC.

Blockchain Twitter, which is renowned for its exaggerated festivities, viewed last week’s bipartisan demonstration of support for cryptocurrency as a historic national accomplishment on par with the enactment of historic civil rights laws or the establishment of the republic. The ecstatic hyperbole was overdone, but it also made sense. When the year began, it appeared that there would be no progress toward crypto reform in Washington, D.C., and that SEC Chair Gary Gensler, the industry’s archenemy, would emerge victorious. But the tide started to turn when a clever national PR effort, spearheaded in part by former Schumer aide Josh Vlasto, made many Democrats aware of an apparent fact: a significant number of individuals under 50 are interested in cryptocurrency.

The fact that former President Donald Trump, a staunch opponent of Bitcoin, is now embracing the sector and setting himself up to possibly draw hundreds of millions of cryptocurrency cash, may have been the last straw for top Democrats. There are rumors that someone in the White House has finally come to the conclusion that electoral politics and campaign contributions take precedence over progressive concerns about cryptocurrency.

What comes next is the question at this point. The legislation that passed this week represent a big symbolic win for the cryptocurrency sector, but they are not yet completed. The first law, which would allow banks to retain cryptocurrency, passed both chambers of Congress but is still subject to President Joe Biden’s veto threat, which is seeming less and less likely by the day. The second bill, which pertains to the regulatory power of the SEC and CFTC, is now in the Senate and may encounter resistance from Sen. Sherrod Brown (R-Ohio), a fervent opponent of cryptocurrencies.

Even if these legislation pass into law, they are only little steps that won’t necessarily benefit the cryptocurrency sector in court, where Gensler is still putting pressure on major firms like Coinbase. In addition, the chairman of the SEC may still pose regulatory challenges by designating other digital assets as securities that fall under his purview. It appears that FDIC Chair Martin Gruenberg, another anti-crypto regulator, would postpone his retirement for as long as possible, even though he left under a sexual harassment controversy.

In summary, the crypto business experienced a record-breaking week in D.C., but it still has a long way to go before it can firmly establish a foothold in the American economy. In the words of Winston Churchill, “This is not even the beginning of the end.” However, it may be the end of the beginning.”

The crypto sector is at a turning point, with recent legislative wins signaling a change in the political environment. The backing of a sizable portion of Democrats indicates that bitcoin is now a mainstream problem deserving of careful thought and regulation, rather than being a fringe worry. This cross-party backing may open the door for future reforms that are more extensive.

The path ahead is not without its challenges, though. Under Gensler’s direction, the SEC has demonstrated that it will not budge in its strict approach to regulating cryptocurrencies. Due to Gensler’s belief that the majority of cryptocurrencies are securities, there are a lot of legal disputes and a lot of market uncertainty. The regulatory landscape is still unstable, and the industry’s legal battles are far from ended.

The possibility of political changes also adds another level of difficulty. Although the crypto business is now experiencing positive growth, political circumstances are subject to swift changes. The direction of cryptocurrency regulation may be affected significantly by upcoming elections and government changes. In order to guarantee ongoing support and advantageous legislation, the industry needs to be on guard and keep up its advocacy activities.

Even when the Democrats’ crypto dam broke, it is only the first step in a much protracted path. To maintain its position in the American economy, the cryptocurrency sector needs to handle continuing regulatory obstacles, possible political changes, and legal disputes. The industry has to build on this momentum in order to achieve long-term success, even though the recent successes have laid a solid foundation. A clear awareness of the changing political scene, persistent public involvement, and smart lobbying will be necessary to pave the way ahead.