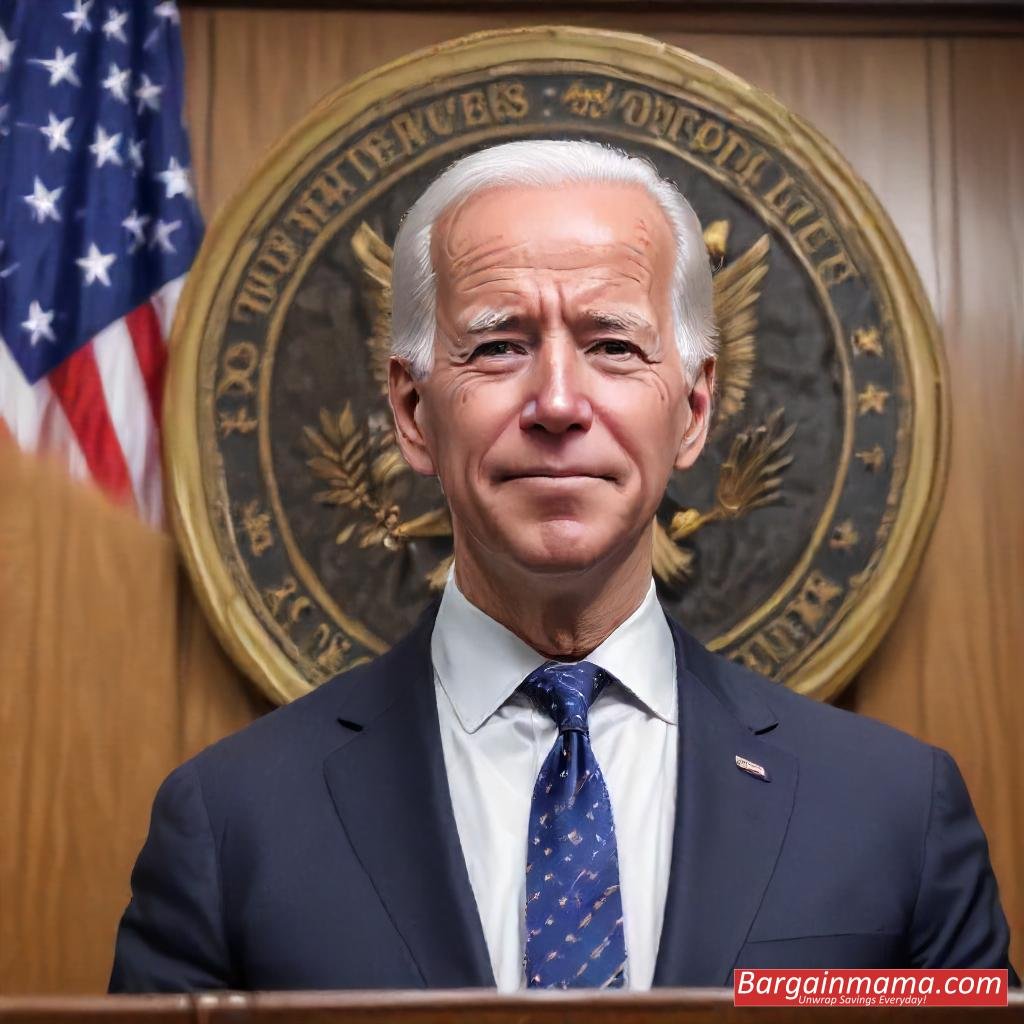

President Joe Biden rejected a legislative resolution that sought to invalidate the US Securities and Exchange Commission (SEC) recommendations, a noteworthy decision that highlights the Biden administration’s cautious stance to bitcoin regulation. The veto, which was issued on Friday night, puts an end to attempts to overturn the guidelines, which the cryptocurrency sector believes have made it far more difficult for it to work with traditional banks.

Comprehending Staff Accounting Bulletin No. 121 of the SEC

Staff Accounting Bulletin No. 121 of the SEC, which was implemented in 2022, is the main topic of contention. Strict accounting guidelines are required under this advise for institutions that store digital assets for their customers. The bulletin states that banks have to include these digital assets as liabilities on their balance sheets, a requirement that has caused financial institutions to experience serious cost problems.

The bulletin’s detractors hail from the banking and cryptocurrency industries, claiming that it carries unaffordable risks and expenses that deter banks from providing digital asset services. Customers’ options for storing their cryptocurrency at conventional banking establishments have been reduced as a result, which might impede integration and innovation in the financial industry.

The Retraction from Congress

With backing from 11 Senate Democrats and a bipartisan effort, the House passed the congressional resolution to repeal this SEC guideline 228–182. Resolution supporters contended that the SEC’s guidelines restrict the alternatives accessible to Americans who want to hold digital assets in conventional banks, so reducing consumer choice and perhaps obstructing the expansion of the cryptocurrency market.

The SEC’s bulletin essentially prevents banks from expanding their services for digital assets by making them excessively expensive and complicated, as highlighted by lawmakers who supported the resolution. They said that overturning this advice would allow for a more thorough integration of bitcoin services into the established financial system, which would benefit customers and promote innovation.

Biden’s Justification for Veto

President Biden emphasized in his veto letter the significance of safeguarding investors and customers in the quickly changing world of digital assets. Biden declared, “Measures that endanger the interests of investors and consumers will not be supported by my administration.” He underlined the necessity of “appropriate guardrails” in order to maximize the advantages and prospects presented by the development of crypto-assets without jeopardizing security and stability.

The administration of Joe Biden has often emphasized the need for a fair approach to regulating cryptocurrencies. The President indicated that he would be open to working with Congress to create an all-encompassing regulatory structure that guarantees innovation as well as investor and consumer protection.

A Wider Range of Regulations

This veto takes place in the midst of a larger discussion on how to control the US government’s expanding bitcoin sector. Citing insufficient consumer and investor safeguards, the White House rejected legislation approved by the House earlier this month that sought to establish a regulatory framework for digital assets. It did not, however, go so far as to veto, suggesting that talks were still open.

The administration’s position shows that it is taking a cautious but open approach to drafting laws that appropriately handle the intricacies of digital assets. The administration hopes to explore the inventive potential of cryptocurrencies while reducing the dangers associated with its volatile and sometimes speculative market by pushing for strict regulations.

Responses from Banks and the Crypto Industry

Traditional financial institutions and the bitcoin sector have differing opinions about the President’s veto. The SEC’s guidelines are seen by many in the cryptocurrency industry as being too restrictive and harmful to innovation. They contend that banks are discouraged from entering the digital asset market by the bulletin’s high costs and obligations, which restricts consumer access to regulated and safe cryptocurrency services.

However, some banks have retaliated against the SEC guidelines as well, claiming that it puts an excessive financial burden on them. They contend that in order to allow them to provide digital asset services without having to pay excessive fees, a more flexible regulatory framework is required.

The Way Ahead

The veto emphasizes the continuous conflict that exists between encouraging innovation in the bitcoin space and making sure that consumer safety and financial stability are sufficient. Finding a compromise that protects the interests of consumers and the larger financial system while fostering the expansion of digital assets will probably be the main goal of the Biden administration’s ongoing interactions with Congress.

The President’s dedication to collaborating with legislators to create an all-encompassing regulatory structure indicates a persistent endeavor to manage the intricacies of cryptocurrency legislation. In the end, this strategy seeks to shape the future of the cryptocurrency market in the United States by striking a balance between the inventive potential of digital assets and the requirement for strong safeguards.