The Biden-Harris administration is about to approve and put into effect big tax hikes on some Chinese imports this week. However, U.S. businesses may put pressure on the administration to take a softer stance. Manufacturers in many areas, such as electric cars and utility equipment, want the planned taxes to be lowered, put off, or thrown out completely. They also want more industries to be left out of the process.

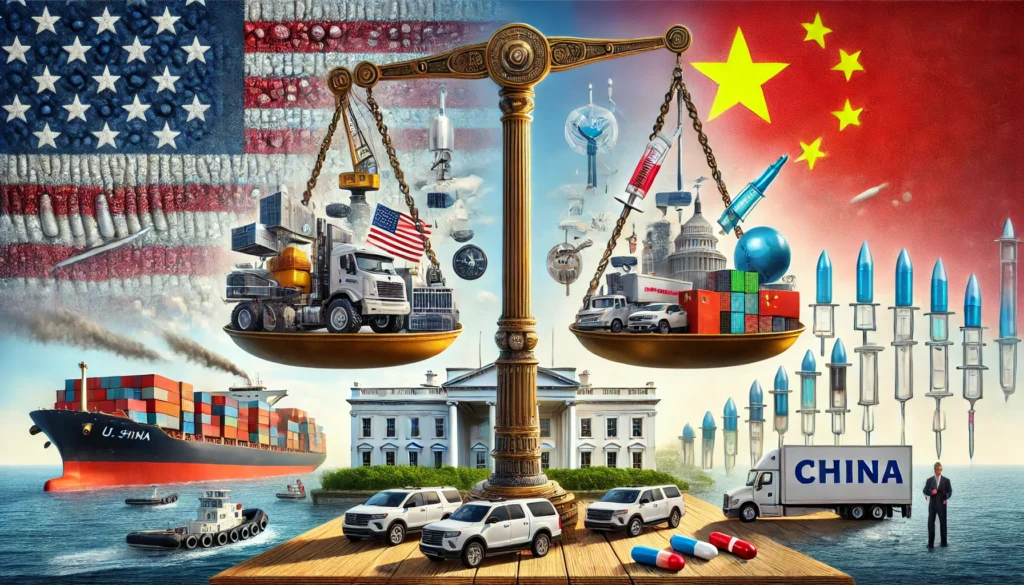

President Joe Biden said in May that he was going to sharply raise taxes on a number of Chinese goods to protect U.S. companies from China’s overproduction. As part of the suggested changes, duties on Chinese electric cars would go up four times to 100%, duties on semiconductors and solar cells would go up twice to 50%, and duties on lithium-ion batteries and strategic goods, such as steel, would go up to 25%. The taxes were supposed to start on August 1, but they were pushed back until September while the office of the U.S. Trade Representative read over 1,100 public comments. By the end of August, a final choice should have been made.

After Vice President Joe Biden quit in late July, Kamala Harris became the Democratic Party’s presidential candidate. This is the first major trade policy move by the government since then. Whether to lower or keep the taxes in place has a lot of political weight and could have effects on the next presidential election.

Reducing taxes could get Harris in trouble with Republicans, who might say that she is being too soft on China trade, especially since Trump has promised to put even higher tariffs on Chinese goods if he wins the election. On the other hand, keeping the steep price rises in place could make some Democrats and U.S. businesses angry about rising costs.

China has been very against the planned taxes. In fact, Chinese Foreign Minister Wang Yi called them “bullying” and threatened to take action in response. The U.S. move is likely to happen at the same time that U.S. National Security Adviser Jake Sullivan goes to China to talk with Wang and try to ease tensions between the two countries before the election in November.

Concerns for the Industry: Cranes and Syringes

Industries that depend on Chinese goods and don’t have many or any U.S. options have spoken out against the new taxes the loudest. A 25% tax is part of the administration’s plan for ship-to-shore cranes made in China. There are no U.S. companies that make these cranes. Eight cranes worth $18 million each are on order from China’s state-owned ZPMC for the Port of New York and New Jersey. The port is worried that the higher taxes will put a lot of stress on its resources.

A number of Democratic senators, such as Tim Kaine and Mark Warner from Virginia and Raphael Warnock and Jon Ossoff from Georgia, are worried about how the taxes will affect ports in their states. They want orders for Chinese cranes that have already been placed to be exempt from the new taxes.

Warnock and Ossoff have also asked the USTR to rethink its plan to put a 50% tax on needles, saying that it could affect the supply of syringes used to feed newborn babies.

The Auto Industry’s Call

Ford Motor Company is also worried, especially about taxes on fake graphite, which is an important part of batteries for electric cars. Ford has asked that the planned taxes be lowered, pointing out that it relies almost entirely on secondary-particle graphite from China at the moment.

Autos Drive America, a group that speaks for foreign-brand cars, wants tariffs on batteries, modules, cells, and important minerals to stay the same at least until 2027. The group says that steady taxes are necessary to protect U.S. production investments and get more people to buy electric cars.

Divisions of the steel industry

A lot of businesses have asked for relief from the planned tariffs, but some have pushed for even bigger steps. Outokumpu, a Finnish company that makes stainless steel and has a mill in Alabama, has backed Biden’s plan to raise tariffs on steel made in China from 7.5% to 25%. To stop people from getting around the tariffs, the company has also asked that these taxes be put on all steel goods that are melted and poured in China but then handled in other countries, like Vietnam.

Outokumpu has also pushed for higher taxes on other types of stainless steel goods, such as cutlery, refrigeration, and brewing equipment.

As the Biden-Harris administration gets ready to make its final decision, businesses all over the U.S. are keeping a close eye on it, hoping for a solution that strikes a good mix between nationalism and economic realism.