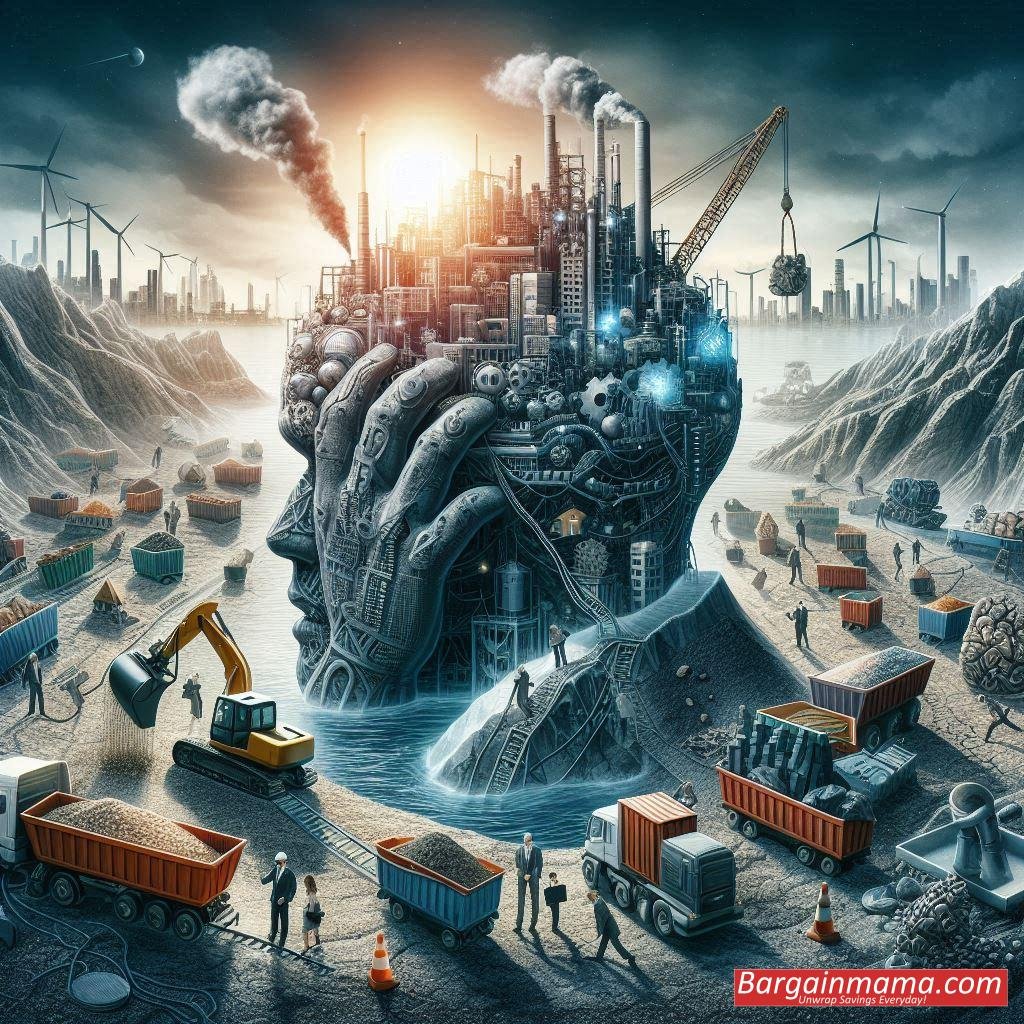

Currently, there is uncertainty around the investment landscape for crucial minerals that are necessary for the energy transition. Industry participants express reluctance because of the government’s waning commitment to zero-carbon targets and the shifting demand from consumers for electric cars (EVs).

The coming years are still unknown, even while it is obvious that large amounts of elements like copper, cobalt, and lithium are required in the long run to help transition away from fossil fuels. At last week’s World Materials Forum in Paris, this was a hot issue.

Twelve U.S. states and the European Union have set lofty goals to outlaw the sale of new gasoline-powered vehicles by 2035. On the other hand, there is growing doubt about achieving these objectives. “I think there is a lot of doubt right now that this will happen,” Mathias Miedreich, the former CEO of Umicore, a recycling and battery materials firm based in Belgium, said at the ceremony. “That makes it very difficult to invest.”

May saw Miedreich’s resignation from Umicore. The company then revised down its 2024 profit estimate because of poor demand estimates for battery materials in the context of a cooling EV industry. May sales of new battery-electric cars in the EU decreased by 12% over the same month last year.

“A few years ago, financing was not a major concern,” said Stephane Michel, president of TotalEnergies Gas, Renewables & Power. “You can still find capital now, but you have to have the right project.” Stellantis and Mercedes are partners in the ACC EV battery joint venture, which TotalEnergies is a component of. Plans for future factories in Germany and Italy were recently put on hold by this joint venture.

An CEO from a significant European chemicals company that provides battery materials brought attention to a widely held belief in the sector: the energy transition will take an extra two years, delaying 2030 estimates to 2032. “That’s the current opinion, but it might shift and become more grave. It’s difficult to say,” the executive told Reuters, seeking to remain anonymous because she didn’t have permission to speak with the media.

An executive from a multinational corporation that produces materials for EV batteries observed that, in contrast to Europe and the US, demand for crucial materials is stronger in China and Asia. “Where should we allocate our next capacity is the question. The market is shifting really quickly, so you have to be very nimble,” he said.

The investment in key minerals continues to be a crucial, if uncertain, component of the global effort to move towards a zero-carbon future. Stakeholders in the industry are closely monitoring developments, striking a balance between strategic agility and cautious optimism.